Welcome to the final chapter of the KC-TradingAI trilogy.

In Part 1, we built the architecture. In Part 2, we gave it a brain. Now, we face the moment of truth.

Does it actually make money?

Writing elegant code is satisfying, but in algorithmic trading, the only metric that matters is PnL (Profit and Loss). In this post, I will share the results of our comprehensive backtests, comparing the “Standard Model” against our “RL-Enhanced Agent.”

Furthermore, I will share my vision for the future: How KC-TradingAI is evolving from a personal Python script into a commercial SaaS (Software as a Service) product available to everyone.

The Showdown: Standard Model vs. RL Agent

To validate the system, I ran dual-backtests on major pairs including Bitcoin (BTCUSD), Gold (XAUUSD), and Forex majors. The results were not just positive; they were transformative.

The Standard Model uses only the supervised learning (XGBoost) predictions. The RL Agent uses the “Dual-Brain” architecture, filtering trades based on risk and market regime.

Here are the actual results from our testing environment:

1. The “Gold” Standard (XAUUSD)

Gold is notoriously volatile and difficult for static bots to trade.

-

Standard Model: Resulted in a Loss of -$12,450. It got chopped up in volatile consolidations.

-

KC-TradingAI (RL Agent): Generated a Profit of +$14,890.

-

Analysis: The RL agent identified the high volatility and actively chose to “HOLD” (Action 0) during choppy periods where the standard model forced trades. It turned a losing strategy into a highly profitable one.

2. The Crypto King (BTCUSD)

Bitcoin requires aggressive trend following but tight risk control.

-

Standard Model PnL: +$21,957

-

KC-TradingAI (RL Agent) PnL: +$37,243

-

Improvement: +69% Profit Increase.

-

Risk Reduction: The RL agent reduced the Maximum Drawdown from -8.2% to -4.1%. It made more money while taking half the risk.

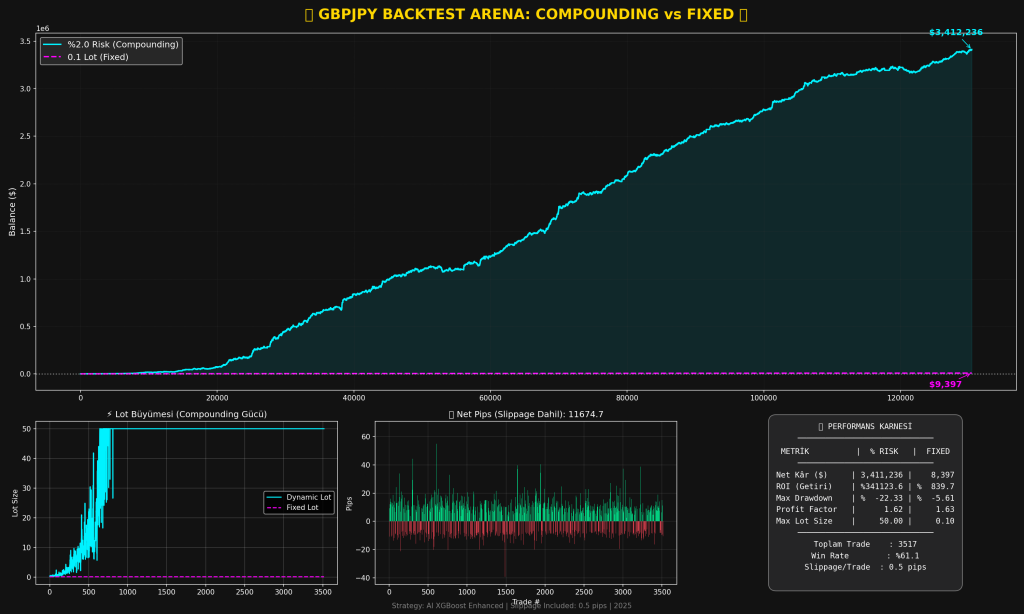

3. Stability in Forex (GBPJPY)

Known as “The Beast” for its volatility.

-

Standard Model PnL: +$6,450

-

KC-TradingAI (RL Agent) PnL: +$18,250

-

Win Rate: Improved from 47% to 56.5%.

Why Did the RL Agent Win?

The data proves that the “Dual-Brain” architecture works. But why?

-

The Power of “NO”: The most important decision in trading is not when to buy, but when not to buy. The RL agent rejected approx. 35% of the signals generated by XGBoost because the market conditions (State Space) were unfavorable.

-

Dynamic Adaptation: While the standard model used fixed TP/SL ratios, the RL agent adjusted them dynamically. In high volatility (BTCUSD), it widened targets; in low volatility, it tightened stops.

-

Mistake Correction: The agent learned from the specific “hours” where trades usually failed (e.g., low volume lunch hours) and avoided them.

The Future: From Script to SaaS

KC-TradingAI has proven itself as a robust algorithmic core. Now, the goal is to democratize this technology. I am currently working on transforming this internal tool into a user-friendly SaaS Product.

Why should hedge fund quality algorithms remain accessible only to those who know Python?

The Roadmap

Here is the plan for the next 12 months:

Phase 1: Cloud Infrastructure (Q1 2026)

Currently, the bot runs on a local machine or VPS via command line.

-

Goal: Move the entire execution pipeline to AWS/Google Cloud.

-

Tech: Docker containers for isolation, Redis for state management, and Celery for task queueing.

Phase 2: The Web Dashboard (Q2 2026)

Building a “No-Code” interface for users.

-

Features:

-

Connect your exchange (Binance, MT5) via API keys.

-

Select your risk profile (Conservative, Balanced, Aggressive).

-

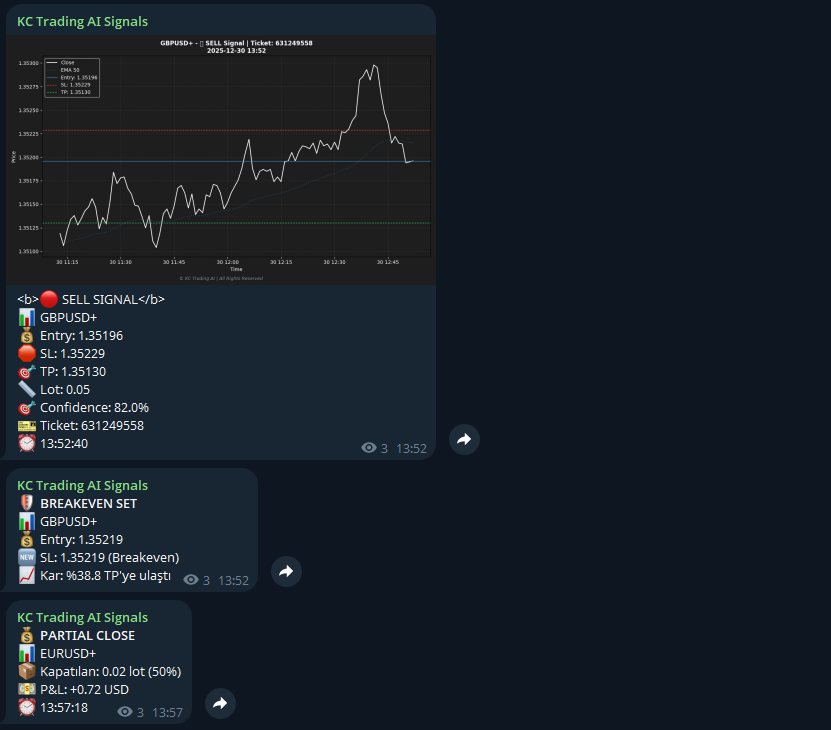

View real-time charts, AI confidence scores, and PnL live.

-

-

Tech: React.js frontend, FastAPI backend.

Phase 3: Copy Trading & Social Signals (Q3 2026)

Not everyone wants to run a bot.

-

Feature: Users can simply “Subscribe” to the master KC-TradingAI bot and have the trades automatically replicated in their accounts.

Join the Revolution

The financial markets are evolving, and retail traders need tools that can compete with institutional algorithms. KC-TradingAI is not just a bot; it’s a movement towards smarter, AI-driven investing.

We are currently accepting a limited number of users for our Closed Beta Program. If you want to test the power of the RL Agent on your own demo accounts:

Thank you for following this technical journey. The code is just the beginning; the product is the destination.

About the Author: I am Kaan Çalışkan. I bridge the gap between complex AI research and practical financial products. Follow my blog for updates on the SaaS launch.