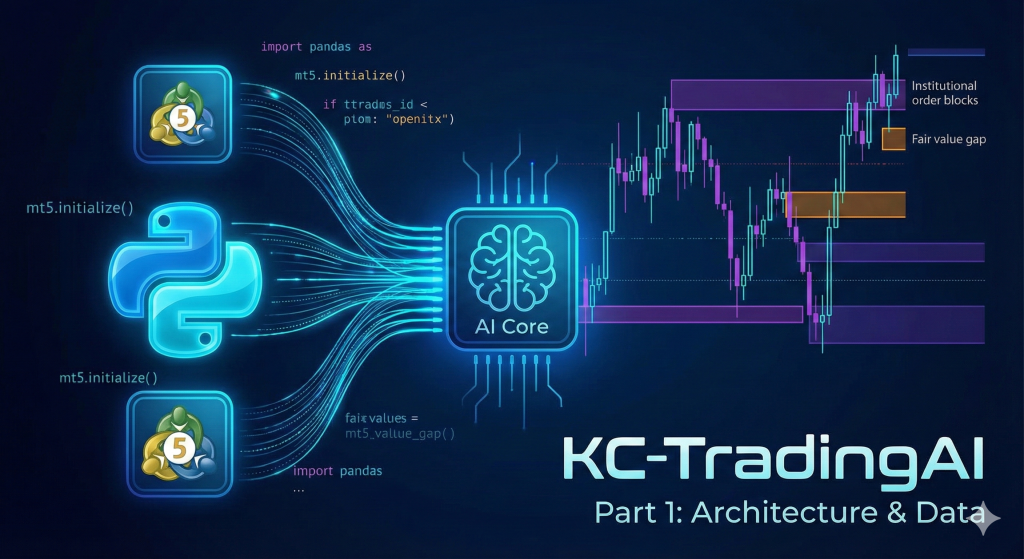

Welcome to the final chapter of the KC-TradingAI trilogy. In Part 1, we built the architecture. In Part 2, we gave it a brain. Now, we face the moment of truth. Does it actually make money? Writing elegant code is satisfying, but in algorithmic trading, the only metric that matters is PnL (Profit and Loss). In this post, ...